- Devon Energy Corporation’s stock is trading at $48.39 with an increase of over 3.5% in today’s market session

- Devon Energy Corporation’s stock has moved over 12% in a week.

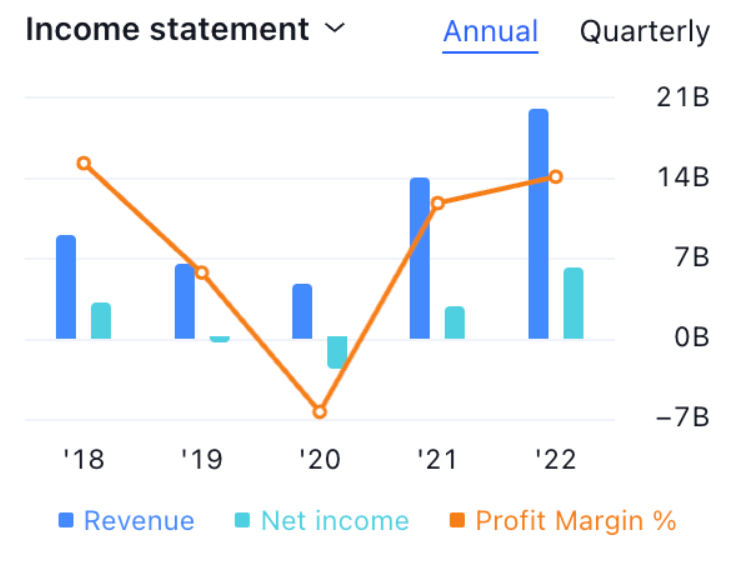

- Devon Energy Corporation’s annual profit margin is rising.

Devon Energy Corporation (NYSE: DVN) is involved in the exploration, development, and extraction of oil and natural gas resources.

DVN stock is currently moving in an uptrend. The price took support and is now showing a sign of upward movement.

Financial Data of Devon Energy Corporation (DVN) stock

The current trading price of DVN stock stands at $48.39, reflecting a minor increase of 3.64% in today’s market session. The company boasts a share float of 636 million shares and an average daily trading volume of 10.12 million.

DVN stock reached a peak of $78.82 in October 2022, following which it began a gradual descent, resulting in a decline of nearly 45%. However, it discovered support at the $43 level, facilitating a price rebound. Currently, the stock is consolidating and making efforts to recover, showcasing an overall favorable structure.

Market analysts have projected a target price of $60.8 for DVN in the upcoming year, representing a 25% increase from the current price. Furthermore, the technical indicators offer a ‘buy’ signal for the stock.

DVN stock maintains a payout ratio of 47.23% and offers an attractive dividend yield of 7.13%. The company consistently distributes dividends to its shareholders, highlighting a robust financial position.

Devon Energy Corporation has shown positive financial performance, with its annual profit margin increasing from 20.23% in 2021 to an impressive 30.3% in 2022. Additionally, the company has outperformed its estimated earnings.

Devon Energy Corporation (DVN) Stock Price Analysis

DVN by writer50_tcr on TradingView.com

Technical Indicators Summary:

DVN stock is demonstrating a bullish trend, marked by the MACD line moving above the signal line and the emergence of a green histogram. These conditions indicate a prevailing bullish sentiment, suggesting the possibility of price increases in the days ahead.

Moreover, the RSI line for DVN stock remains situated above the 14-day SMA line, with both lines in proximity to the 70 level. This robust RSI line further reinforces the likelihood of upcoming price appreciation.

Conclusion

Based on the analysis, the price of DVN stock is on an upward trajectory, and the overall structure of the stock is favorable. Positive indicators and timely dividend payments to shareholders further support this outlook. Additionally, the finances of the company are strong, suggesting the possibility of a price rise in the upcoming days.

Technical Levels

- Support Level: $43.9

- Resistance Level: $53.6

Disclaimer

The views and opinions of the author, or anyone named in this article, are for informational purposes only. They do not offer financial, investment, or other advice. Investing or trading crypto assets involves the risk of financial loss.